Common shareholder fairness is a typical baseline for measuring a company’s returns over time. Even though it’s essentially mostly theoretical, continuous compounding is usually used when pricing and valuing derivatives, foreign exchange, and futures contracts. In this case, continuous compounding supplies a useful approximation when analyzing these complicated products. If we wish to differ the compounding frequency, we should modify each the rate, nper, and pmt arguments within the FV function.

What’s The Method To Calculate Annuity In Present Worth And Future Value?

Nevertheless, it’s crucial to account for factors like market volatility and ranging rates of interest, which might impression the accuracy of these projections. Understanding the distinction between future worth and present value—where the latter assesses at present’s price of future sums—can enrich one’s monetary planning and funding strategies. Rigorously evaluating these calculations can information investors towards smarter, well-informed monetary decisions. The Present Worth (PV) of an funding is what that investment’s future cash flows are worth TODAY based mostly on the annualized rate of return you could potentially earn on different, related investments (called the “Discount Rate”).

The formula is calculated based mostly on two essential features – The current Value of the Odd Annuity and the Present Value of the Due Annuity. You can use the identical method to evaluate different investment options. For extra on compounding and a present value calculator, read about the time worth of money. Yes, there’s also inflation, however that’s not the important thing factor; in an surroundings with 0% inflation, $100 at present would even be worth more than $100 in 1-2 years because you may nonetheless make investments it and end up with more than $100 in 1-2 years.

Current Value Formula And Calculation

Based on the same logic, a sum of money that will be obtained at a future date will not be value as much as that very same sum today. For example, let’s say you’re evaluating a possible funding that may price you $5,000 in today’s dollars, and you expect annualized returns of ~8% per year over 8 years. This slight distinction in timing impacts the long run worth as a result of earlier payments have more time to earn interest.

- All future receipts of cash (and payments) are adjusted by a discount fee, with the post-reduction amount representing the present worth (PV).

- Exterior factors such as inflation can adversely affect an asset’s future worth.

- The following 12 months, nonetheless, the account complete is $1,100 somewhat than $1,000.

- While the present worth is used to determine how a lot interest (i.e. the speed of return) is needed to earn a enough return sooner or later, the longer term worth is often used to project the value of an investment sooner or later.

Calculating the interest rate using the present value formulation can, at first, seem inconceivable. Nevertheless, with somewhat math and a few common sense, anybody can rapidly calculate an investment’s interest rate with simply its worth, face worth, and period. Calculating a company’s growth on an annual basis may help determine if its stock will be a great funding. As shown in the screenshot above, Excel’s EXP operate might help when calculating the future value of a repeatedly compounded investment. The weak point of the FV perform is that we assume the interest rate is a continuing price, as are the additional funds.

This idea of Present Value is critical in valuation as a end result of it determines what belongings and corporations are worth. With this formulation, all we have to do is plug the identified phrases into the equation, and we’ll have the interest rate. That stated, this isn’t the simplest formulation on the planet, and a scientific or monetary calculator shall be required to achieve the ultimate result. Given the next low cost rate, the implied present worth will be lower (and vice versa). The current value (PV) concept is fundamental to company finance and valuation. Note that the “Expected or Focused Annualized Return” right here is not the interest rate; it’s usually the Weighted Average Value of Capital (WACC) or the Value of Fairness.

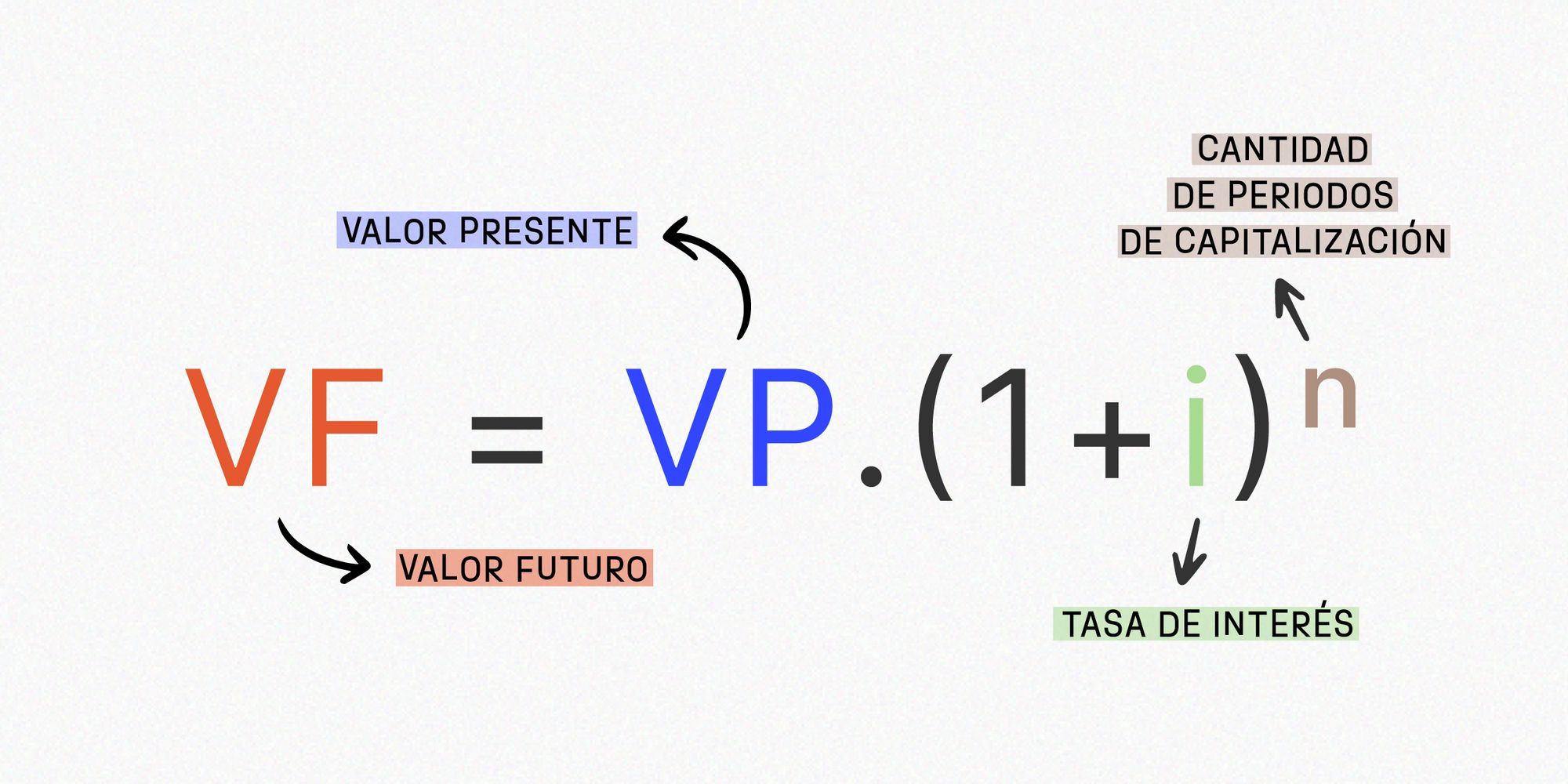

By altering directions, future worth can derive current value and vice versa. The future worth of $1,000 one year from now invested at 5% is $1,050, and the current worth of $1,050 one yr from now, assuming 5% curiosity, is $1,000. Sometimes you might know the longer term value and need to decide the principal amount required to achieve that future worth at a selected interest rate over a certain period. When you borrow cash, you are to repay, someday sooner or later, both the original quantity borrowed (the principal or current value) and the amount of curiosity charged for the loan interval. The sum of the original amount and the interest charged is the longer term value asciimathS/asciimath (maturity worth or accumulated value).

Present Worth Excel Exercise

The foundation right here is the time worth of money, i.e., that $100 right now is price MORE than $100 in 1-2 years from now since you could invest that $100 right now and earn more by then. In the case of a T-bill, we all know our purchase price, or current worth; its face worth, or future value; and how lengthy till it matures. For short-term Treasuries, this duration could be 30 days to 182 days, depending on the precise observe.

Department of Treasury bond website, to estimate the expansion and future value of savings bonds. The Interior Revenue Service imposes a Failure to File Penalty on taxpayers who don’t file their returns by the due date. The penalty is calculated as 5% of unpaid taxes for each month a tax return is late, as a lot as https://www.simple-accounting.org/ a restrict of 25% of unpaid taxes. For example, the primary yr earns 10% of $1,000, which is $100, in curiosity. The following yr, nevertheless, the account whole is $1,100 rather than $1,000.

Bankrate.com is an independent, advertising-supported writer and comparability service. We are compensated in trade for placement of sponsored products and services, or by you clicking on sure hyperlinks posted on our web site. Subsequently, this compensation could impact how, where and in what order products appear inside itemizing classes, except where prohibited by legislation for our mortgage, house equity and other residence lending products. Different factors, such as our own proprietary web site rules and whether or not a product is obtainable in your space or at your self-selected credit rating vary, can also impact how and the place products seem on this web site. While we attempt to offer a variety of provides, Bankrate does not embody information about each monetary or credit score product or service.