Paysend is a digital platform that offers cross-border money transfers to individuals and businesses. The company was founded in 2017 and has since expanded its services to over 90 countries worldwide. In this review, we will take a closer look at the features and benefits of Paysend and evaluate whether it is a good choice for your international money transfer needs.

Pros

- Ease of Use

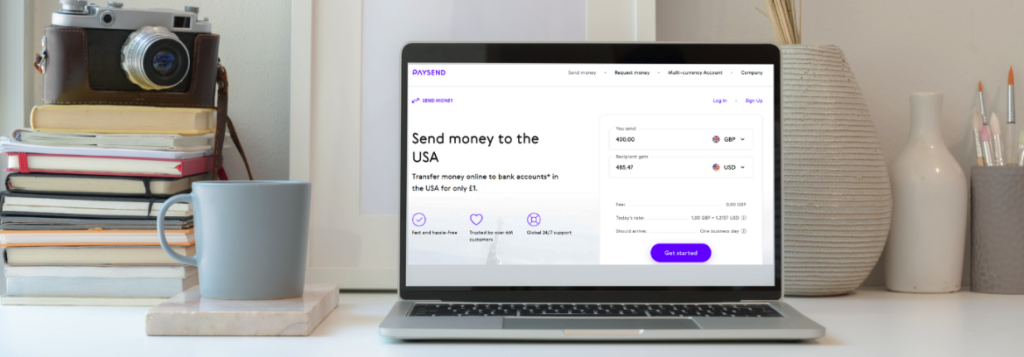

One of the biggest advantages of using Paysend is its ease of use. The platform offers a user-friendly interface that makes it easy for customers to initiate transactions. Users can send money to recipients using their mobile phones, tablets or computers. The process is straightforward, and there is no need to visit a bank or an agent in person.

- Transaction Speed

Paysend is known for its fast transaction speeds. The platform promises to deliver funds to recipients within minutes in most cases. The speed of the transaction is dependent on the recipient’s location, the payment method used, and the time of day the transaction is initiated. Paysend offers three payment options; bank transfer, card payment, and local payment methods.

- Fees

Paysend’s fees are competitive and transparent. The platform charges a fixed fee of $2 for each transaction, regardless of the amount transferred. This makes it an excellent choice for small and medium-sized transfers. However, it’s worth noting that the platform’s exchange rate may not be as competitive as other digital money transfer platforms.

- Security

Paysend takes security seriously, and the platform is fully regulated by the Financial Conduct Authority (FCA) in the UK. The platform uses state-of-the-art encryption technology to protect customer data and transactions. Paysend also offers a two-factor authentication process to ensure that only authorized users can access their accounts.

- Customer Service

Paysend offers excellent customer service, and the platform is available 24/7. Customers can reach out to the platform’s support team via email, phone or live chat. Paysend also has an extensive knowledge base that answers frequently asked questions, which makes it easy for customers to find solutions to common issues.

CONS

- Limited payment options: While Paysend offers multiple payment options, it may not support all the payment methods preferred by some customers. This could be a problem for individuals or businesses who prefer to use alternative payment methods.

- Limited currency options: Paysend only supports a limited number of currencies, which may not meet the needs of some customers who require transfers to less common currencies.

- Exchange rates: While Paysend’s fees are competitive, its exchange rates may not be as favorable as those offered by other digital money transfer platforms. This could result in customers receiving less money than they expected after the exchange rate is applied.

- Minimum transfer amount: Paysend has a minimum transfer amount of $10, which may not be suitable for those who want to send smaller amounts of money.

- Transaction limits: Paysend has daily, weekly, and monthly transaction limits that may not meet the needs of businesses or individuals who require larger transfer amounts.

Overall, while Paysend is a good option for many customers, these potential drawbacks should be taken into consideration when evaluating whether it is the right platform for your needs.

FAQs

Q1).What is Paysend?

Paysend is a digital platform that offers cross-border money transfer services to individuals and businesses in over 90 countries worldwide.

Q2).How does Paysend work?

To use Paysend, customers need to sign up for an account, and then they can initiate a money transfer by providing the recipient’s details and payment information. Paysend then facilitates the transfer of funds using one of its payment methods, and the recipient receives the funds in their local currency.

Q3). What payment methods does Paysend support?

Paysend supports bank transfers, card payments, and local payment methods, depending on the country and currency involved.

Q4). What are the fees for using Paysend?

Paysend charges a fixed fee of $2 per transaction, regardless of the amount transferred. However, customers should be aware that there may be additional fees charged by banks or payment providers involved in the transaction.

Q5). How long does it take to receive funds through Paysend?

Paysend promises to deliver funds to recipients within minutes in most cases, depending on the recipient’s location, payment method, and the time of day the transaction is initiated.

Q6). Is Paysend secure?

Yes, Paysend takes security seriously, and the platform is fully regulated by the Financial Conduct Authority (FCA) in the UK. Paysend uses state-of-the-art encryption technology to protect customer data and transactions and also offers two-factor authentication for added security.

Q7). What currencies does Paysend support?

Paysend supports a limited number of currencies, including USD, EUR, GBP, AUD, CAD, CHF, CZK, DKK, HKD, HUF, NOK, PLN, SEK, and SGD.

Q8). Are there any transfer limits with Paysend?

Yes, Paysend has daily, weekly, and monthly transfer limits that vary depending on the country and currency involved. Customers should check the specific limits for their transaction before initiating the transfer.

Q9). Does Paysend offer customer support?

Yes, Paysend offers 24/7 customer support via email, phone, and live chat. Paysend also has an extensive knowledge base that answers frequently asked questions.

Q10). How can I sign up for Paysend?

You can sign up for a Paysend account on the company’s website or by downloading the mobile app from the App Store or Google Play.

Conclusion

Paysend is an excellent choice for those looking for a fast, secure and affordable way to send money abroad. The platform offers competitive fees and fast transaction speeds, and its user-friendly interface makes it easy for customers to initiate transactions. However, if you are looking for the most competitive exchange rates, you may want to compare Paysend’s rates with other platforms before making a final decision. Overall, Paysend is a great option for those looking for a hassle-free cross-border money transfer experience.

1 Comment